Kumusta, kabayan! Whether you’re an OFW in Dubai, a nurse in London, or working in tech in Singapore, sending money back home to your loved ones in the Philippines is probably a regular part of your life. But with so many money transfer services available today, how do you choose the best one? Don’t worry – we’ve created this comprehensive guide to help you navigate the world of online remittances to the Philippines. We’ll break down everything you need to know about sending money home safely, quickly, and cost-effectively.

Why Send Money Online?

Gone are the days when sending money meant standing in long queues at remittance centers or paying hefty fees at traditional banks. The digital revolution has transformed how we transfer money across borders, making it more convenient, faster, and often cheaper than conventional methods. Online money transfers offer several advantages that make them particularly attractive for Filipinos working abroad. The ability to send money anytime, anywhere, competitive exchange rates, lower fees, and the convenience of tracking your transfers in real-time have made digital remittances increasingly popular among our kababayans worldwide.

Understanding Exchange Rates and Fees

Before we dive into the different platforms and methods, let’s talk about something that significantly impacts how much money your family actually receives – exchange rates and fees. When sending money to the Philippines, you’ll encounter two types of costs: the transfer fee and the exchange rate margin. The transfer fee is straightforward – it’s what the service charges you to send money. However, the exchange rate margin is less obvious but equally important. This is the difference between the mid-market rate (the real exchange rate you see on Google) and the rate the service offers you. Some providers might advertise “zero fees” but make their money by offering less favorable exchange rates.

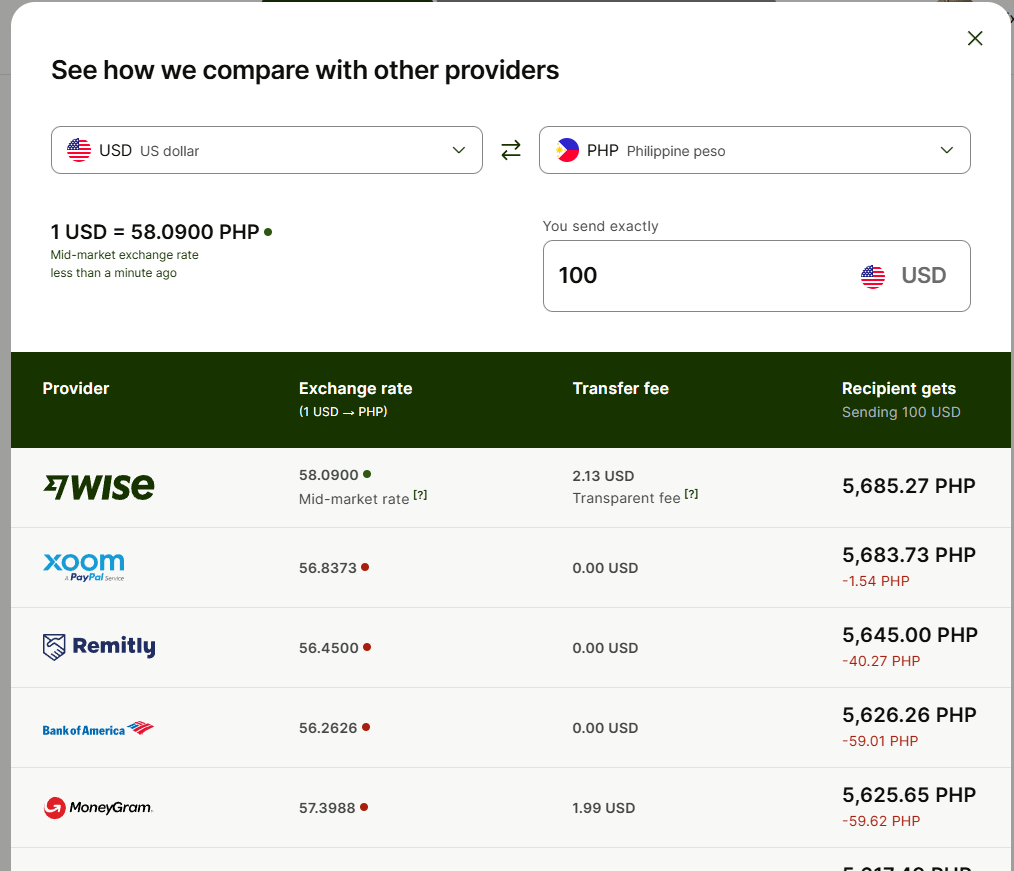

Exchange Rate Comparison (as of February 2025) from Wise

Note: Rates and fees are subject to change and may vary based on transfer amount and payment method.

Popular Money Transfer Services for the Philippines

Let’s explore some of the most reliable and widely-used money transfer services that cater to Filipinos abroad. Each platform has its unique features, advantages, and limitations, so understanding these can help you choose the best option for your specific needs.

Wise (formerly TransferWise)

Founded in 2011, Wise has gained popularity for its transparency and competitive rates. They use the real mid-market exchange rate and clearly display their fees upfront. The platform is particularly good for larger transfers due to its competitive rates and straightforward fee structure. You can send money directly to Philippine bank accounts, and while transfers might take 1-2 days, the savings often make it worthwhile.

Xoom (a PayPal Service)

Xoom is known for its speed and convenience, especially for cash pickups. It partners with major Philippine banks and remittance centers like Cebuana Lhuillier, MLhuillier, and Palawan Express. While their exchange rates might not always be the most competitive, their instant or near-instant transfer speeds make them popular among Filipinos who need to send money urgently.

Remitly

Remitly has become a favorite among Filipino users for its user-friendly mobile app and competitive first-time user promotions. They offer both express and economy transfer options, letting you choose between speed and cost-effectiveness. Their strong partnerships with Philippine banks and extensive cash pickup locations make them a versatile choice.

Step-by-Step Guide to Sending Money Online

Now, let’s walk through the process of sending money online to the Philippines. While the exact steps might vary slightly between platforms, the general process remains similar:

1. Choose Your Platform and Create an Account

- Select a money transfer service based on your needs (speed, cost, transfer limits)

- Register an account using your valid ID and proof of address

- Complete any required verification processes

- Download the platform’s mobile app (if available) for convenience

2. Set Up Your Transfer

- Enter the amount you want to send

- Choose your payment method (bank transfer, debit card, credit card)

- Select the delivery method (bank deposit, cash pickup)

- Compare the exchange rate and fees before proceeding

3. Enter Recipient Details

- Input your recipient’s complete name (exactly as it appears on their ID)

- Provide their bank account details or preferred cash pickup location

- Double-check all information to avoid transfer delays

- Save recipient details for future transfers

4. Review and Confirm

- Verify all transfer details, including amount, exchange rate, and fees

- Check the estimated delivery time

- Confirm the total cost of your transfer

- Proceed with payment

Delivery Methods and Processing Times

Understanding different delivery methods and their processing times can help you choose the best option for your situation:

| Delivery Method | Processing Time | Availability |

|---|---|---|

| Bank Deposit | 1-3 business days | 24/7 |

| Cash Pickup | Minutes-Hours | During business hours |

| Mobile Wallet | Minutes-Hours | 24/7 |

| Door-to-Door | 1-3 business days | Business days |

Safety and Security Tips

Keeping your money transfers secure should be a top priority. Here are essential safety measures to follow:

Verify the Service

- Use only licensed and regulated money transfer services

- Check reviews and ratings from other users

- Ensure the platform has proper security certifications

- Look for secure website indicators (https://)

Protect Your Account

- Use strong, unique passwords

- Enable two-factor authentication when available

- Never share your login credentials

- Be cautious of phishing attempts

- Monitor your transfers regularly

Mobile Wallets and Digital Banking Options

The Philippines has seen rapid growth in digital banking and mobile wallet solutions. These platforms offer additional options for receiving remittances:

Popular Mobile Wallets in the Philippines

- GCash: Widely used for everyday transactions

- Maya (formerly PayMaya): Offers digital banking services

- Coins.ph: Supports both traditional and cryptocurrency transfers

Digital Banks

- Tonik: First digital-only bank in the Philippines

- GoTyme: Digital banking with physical kiosks

- Maya Bank: Digital banking arm of Maya

Special Considerations for Different Countries

Depending on where you’re sending money from, there might be specific requirements or limitations to consider:

From the United States

- Transfers above $3,000 require additional documentation

- Some states have specific licensing requirements for money transfer services

- Bank transfers typically take 1-3 business days

From Europe

- SEPA transfers can reduce costs for EUR to PHP conversions

- Strong customer authentication (SCA) requirements apply

- Different platforms may have varying coverage across European countries

From Middle East

- Special promotions often available for OFWs

- Some countries require additional documentation

- Weekend processing times may vary

Cost-Saving Tips and Strategies

Maximize the value of your remittances with these practical tips:

Timing Your Transfers

- Monitor exchange rates using apps or websites

- Consider setting up rate alerts

- Plan regular transfers to avoid emergency fees

- Take advantage of off-peak transfer times

Reducing Fees

- Compare multiple providers before each transfer

- Look for promotional codes and first-time user bonuses

- Consider sending larger amounts less frequently

- Use bank transfers instead of credit cards when possible

Tracking and Managing Your Transfers

Stay informed about your money transfers with these best practices:

Transfer Monitoring

- Use provider’s mobile apps for real-time tracking

- Save transaction references

- Keep digital receipts

- Set up notifications for transfer status updates

Record Keeping

- Maintain a log of all your transfers

- Save confirmation emails

- Document exchange rates and fees

- Keep records for tax purposes

Sources and References:

- Bangko Sentral ng Pilipinas (BSP) – https://www.bsp.gov.ph

- World Bank Remittance Prices Worldwide – https://remittanceprices.worldbank.org

- Philippines Statistics Authority – https://psa.gov.ph

- Individual provider websites (Wise, Xoom, Remitly, WorldRemit)

Disclaimer: This guide is for informational purposes only and does not constitute financial advice. Exchange rates, fees, and service features mentioned are subject to change. Always verify current rates and terms directly with the service provider before making a transfer. While we strive to provide accurate and up-to-date information, we cannot guarantee the accuracy of all details. Please report any inaccuracies to our editorial team at [contact@email.com] for prompt correction.