Kumusta ka, kabayan! Whether you’re an OFW in Dubai, a nurse in London, or working in Singapore, sending money back home to your loved ones in the Philippines is probably a regular part of your life. We know how important it is to make every peso count, especially when you’re working hard abroad to support your family. That’s why we’ve created this comprehensive guide to help you find the most cost-effective ways to send money to the Philippines in 2024. We’ll break down everything you need to know about remittance fees, exchange rates, and transfer speeds, so you can make informed decisions about your hard-earned money.

Why Finding the Cheapest Way to Send Money Matters

When you’re regularly sending money home, even small differences in fees and exchange rates can add up to significant amounts over time. For example, if you’re sending ₱50,000 monthly, a difference of just 1% in fees or exchange rates could mean saving or losing ₱6,000 per year – that’s enough for a nice Noche Buena celebration or several months of utility bills! Understanding your options and choosing the most cost-effective method can help you maximize the amount your family receives, ensuring they get the most value from your remittance.

Understanding Remittance Costs

Before we dive into specific services, it’s important to understand what makes up the total cost of sending money:

Direct Fees

These are the upfront charges you pay for making a transfer. They can be fixed fees (like $5 per transaction) or percentage-based fees (like 1% of the transfer amount). Some providers might advertise “zero fees,” but always check the exchange rate they’re offering, as this leads us to the next important cost factor.

Exchange Rate Margins

This is often the hidden cost of international transfers. Most providers add a markup to the mid-market exchange rate (the rate you see on Google). For example, if the mid-market rate is 1 USD = 56 PHP, a provider might offer 1 USD = 54 PHP, keeping the difference as their profit. This markup can sometimes cost you more than the direct fees!

Additional Bank Charges

Your recipient’s bank in the Philippines might charge a receiving fee, typically ranging from ₱100-₱500. Some sending methods might also incur correspondent bank fees if the money passes through intermediate banks.

Best Money Transfer Services for Philippines (2024)

Based on our analysis of current market rates and user reviews, here are the top services for sending money to the Philippines:

| Service | Transfer Speed | Minimum Transfer | Maximum Transfer | Typical Fee Range | Exchange Rate Markup |

|---|---|---|---|---|---|

| Wise | 0-2 business days | $1 | $1,000,000 | 0.4-0.7% | 0-0.5% |

| Remitly | Minutes to 3-5 days | $1 | $10,000 | $0-3.99 | 0.5-1.5% |

| Xoom (PayPal) | Minutes to 1-2 days | $1 | $10,000 | $0-4.99 | 1-2% |

| WorldRemit | 0-2 business days | $1 | $5,000 | $0-3.99 | 0.5-1.5% |

| Western Union | Minutes to 5 days | $1 | Varies by country | $0-5 | 1-3% |

Detailed Review of Each Service

Wise (Formerly TransferWise)

Wise has consistently proven to be one of the most transparent and cost-effective services for sending money to the Philippines. They use the real mid-market exchange rate and charge a clear, upfront fee. The service particularly shines when sending larger amounts because of their low percentage-based fees and excellent exchange rates. Their mobile app is user-friendly, and they offer multiple delivery options including bank deposit to all major Philippine banks.

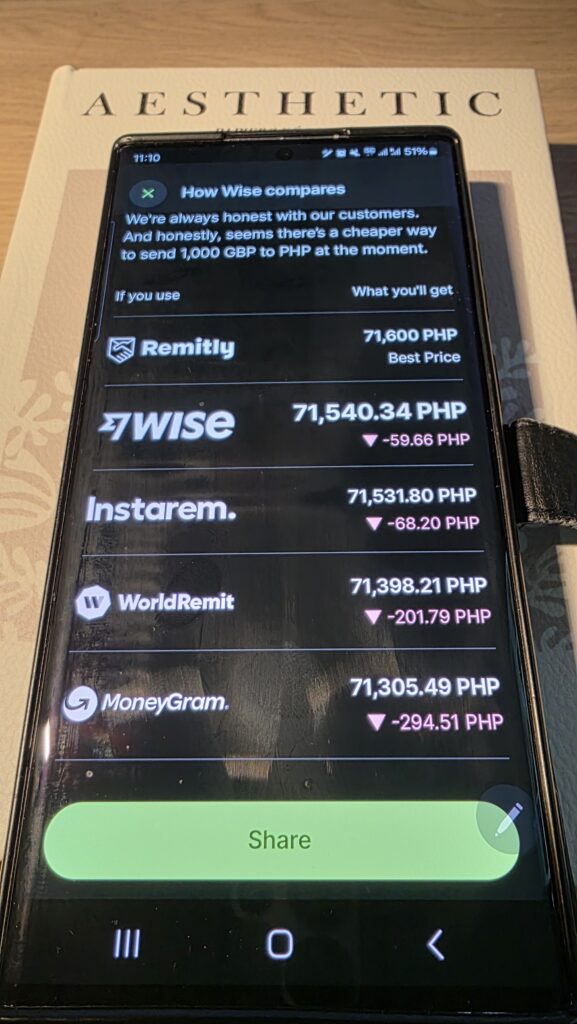

Remitly

Perfect for first-time users, Remitly often offers special deals for your first transfer. They provide two service levels: Economy (cheaper but slower) and Express (faster but more expensive). One of their standout features is the ability to track your transfer every step of the way, giving peace of mind to both sender and recipient. They also frequently run promotions and have a rewards program for regular users.

Xoom (PayPal Service)

Xoom is an excellent choice if you need to send money urgently, as they offer instant transfers to many Philippine banks. While their fees might be slightly higher than some competitors, they make up for it with reliability and speed. They also offer cash pickup options at thousands of locations across the Philippines, including M Lhuillier, Cebuana Lhuillier, and Palawan Express.

WorldRemit

WorldRemit stands out for its competitive rates on smaller transfers and its wide range of delivery options in the Philippines. Besides bank deposits, they offer cash pickup, mobile money, and even door-to-door delivery in some areas. Their service is particularly popular among OFWs in the Middle East and Europe due to their strong presence in these regions.

Western Union

While not always the cheapest option, Western Union remains a reliable choice with the largest network of physical locations both for sending and receiving money. This can be particularly valuable if your recipient needs to collect cash in remote areas of the Philippines. They often run promotions for online transfers, which can make them more competitive on costs.

Tips to Save Money on Transfers

Compare Before Every Transfer

Exchange rates and fees can change daily, so what’s cheapest one day might not be the next. Use comparison sites like Monito or RemitRadar to check current rates across different providers.

Time Your Transfers Strategically

Exchange rates fluctuate throughout the day and week. Generally, mid-week transfers often get better rates than weekend transfers. Setting up rate alerts can help you transfer when the rate is in your favor.

Consider Transfer Speed vs. Cost

If your family doesn’t need the money urgently, choosing a slower transfer option can save you money. The difference between an instant transfer and a 2-3 day transfer can be significant in terms of fees.

Bundle Your Transfers

Instead of sending money weekly, consider sending larger amounts monthly if possible. This can help you save on fixed fees, though always consider your family’s needs first.

Safety and Security Tips

Verify the Service

Only use licensed money transfer services. In the Philippines, check if they’re registered with the Bangko Sentral ng Pilipinas (BSP). For international operations, verify their licenses in your sending country.

Double-Check Details

Always verify the recipient’s information carefully before confirming a transfer. Simple mistakes in account numbers or names can cause delays or lost transfers.

Keep Records

Save all transaction receipts and tracking numbers. These are essential if you need to follow up on a transfer or resolve any issues.

Special Considerations for Different Countries

For OFWs in Middle East

Services like WorldRemit and Western Union have strong presences in Gulf countries and often offer competitive rates for transfers to the Philippines. Some local banks in the UAE and Saudi Arabia also offer special remittance rates for Filipino workers.

For Workers in US/Canada

Digital services like Wise and Xoom are particularly competitive in North America. Bank-to-bank transfers might also be cost-effective due to established corridors between these countries and the Philippines.

For Filipinos in Europe

European senders often get the best deals through digital services like Wise and WorldRemit. Traditional bank transfers within the EU can be expensive due to intermediary bank fees.

For Those in Asia-Pacific

Regional services like InstaReM (now part of Nium) often offer competitive rates for transfers within Asia. Singapore-based OFWs might find good rates through local banks due to strong financial ties between Singapore and the Philippines.

Future of Money Transfers to Philippines

The remittance landscape is constantly evolving with new technologies and services entering the market. Digital wallets and mobile money services are becoming increasingly popular in the Philippines, with services like GCash and PayMaya offering new ways to receive and use remittances. Blockchain and cryptocurrency-based transfers are also emerging as potential alternatives, though they’re still in early stages for practical, everyday use.

Sources and References:

- World Bank Remittance Prices Worldwide: https://remittanceprices.worldbank.org

- Bangko Sentral ng Pilipinas Remittance Statistics: https://www.bsp.gov.ph/statistics/

- Service Provider Websites (as of January 2024):

- Wise: https://wise.com

- Remitly: https://www.remitly.com

- WorldRemit: https://www.worldremit.com

- Western Union: https://www.westernunion.com

- Xoom: https://www.xoom.com

Disclaimer: The information provided in this blog post is for general informational purposes only and was accurate at the time of writing (February 2024). Exchange rates, fees, and services may vary depending on your location, amount sent, and other factors. Always verify current rates and terms directly with the service provider before making a transfer. While we strive to keep this information up-to-date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained in this post. Please report any inaccuracies to our editorial team and we will update the information promptly.